When Life Savings Take a Half-Million Dollar Hit: Susy's Superannuation Nightmare

Randhir Singh - Thursday, 31 July 2025 | 03:15 PM (WIB)

The Invisible Hand: Decoding the Super Shockwave

So, what on earth happened? Was it a rogue trader? A market crash no one saw coming? Not quite. The culprit, it turns out, was something far less dramatic but arguably more insidious: the quiet revaluation of unlisted property assets within her default "Balanced" investment option. Talk about a rude awakening. For most of us, our super fund is a set-it-and-forget-it affair. We choose an option – "Balanced" often being the go-to for its perceived stability – and trust the experts to manage it. But as Susy tragically discovered, beneath the surface of that reassuring "Balanced" label lies a complex world of investments, some of which operate on a different clock.Think of it like this: when you own shares in a company listed on the stock exchange, their value is public knowledge, updated second by second. You see the ups and downs in real-time. But unlisted assets – like large commercial properties, infrastructure, or private equity – are a different beast entirely. They aren't traded daily on a public market. Their valuations are, for lack of a better term, a bit more opaque, a bit more... leisurely. Funds often revalue these assets far less frequently – sometimes quarterly, sometimes even less. This means that when the market tide genuinely turns, as it did with rising interest rates in late 2022, the adjustments can be sudden, severe, and, for members like Susy, absolutely devastating. It’s like discovering your car has a flat tire, not when you’re driving, but when you go to start it up after it’s been parked for months. The damage was there, just not visible until the belated inspection.The Plot Thickens: A Matter of Fairness and Transparency

Susy's story, heart-wrenching as it is, isn't an isolated incident. It highlights a systemic issue, a thorny problem of transparency and valuation disconnects that affects countless members, particularly those nearing or in retirement who are often parked in these default "Balanced" options. For years, when interest rates were low and property markets were booming, these unlisted assets were generally seen as a steady ship, offering smoother returns than the volatile share market. The problem is, when those values eventually had to come down to reflect the new economic reality, it hit like a ton of bricks.Financial experts have been sounding the alarm bells about this very issue. They talk about "valuation disconnects" – the gap between the official, infrequent valuation of unlisted assets and their true, current market value. This isn't just a technicality; it has real-world consequences, particularly regarding what’s known as "intergenerational equity." In a nutshell, if unlisted assets were overvalued for a period, members who withdrew their funds or switched options during that time might have exited at an inflated price. Conversely, those who remained in the fund, or joined later, might then bear the brunt of the subsequent downward revaluation. It's almost like a secret handshake club where some members implicitly pay for the over-optimism of the past. Susy, unfortunately, appears to be one of those who ended up holding the bag.A Call for Clarity: What This Means for Everyone Else

The profound shock Susy experienced – that feeling of her future being snatched away overnight – is a wake-up call for us all. It underscores the critical need for greater transparency in how superannuation funds value their unlisted assets. Members deserve to understand exactly what they're invested in, how those assets are valued, and what risks are inherent in such infrequent revaluations. It’s not about panicking, but about empowering individuals to make informed decisions about their retirement savings.For retirees, this issue is particularly acute. Unlike younger members who have years to recover from market downturns, those in retirement are drawing down on their capital. A sudden, massive drop can fundamentally alter their lifestyle, their plans, and their very sense of security. Susy's story is a stark reminder that while diversification is good, understanding the underlying mechanics of your investments – even the ones managed by the pros – is paramount. It’s a complex world out there, but perhaps with more stories like Susy's coming to light, the superannuation industry will be nudged towards a future where clarity isn’t a privilege, but a fundamental right.

Sabrina Carpenter: The Unseen Layers Beneath the Pop Princess Crown

6 months ago

Avril Lavigne Back in the Limelight: High-Profile Collaborations, World Tours, and Conspiracy Rumors

6 months ago

Taylor Swift Breaks Instagram Record on Engagement Post

6 months ago

Anne Hathaway in the Spotlight During the Filming of The Devil Wears Prada 2

6 months ago

Bruce Willis and His Family's Dementia Struggle

6 months ago

The Engagement Watch: Why Taylor Swift and Travis Kelce Are Keeping Us All on the Edge of Our Seats

6 months ago

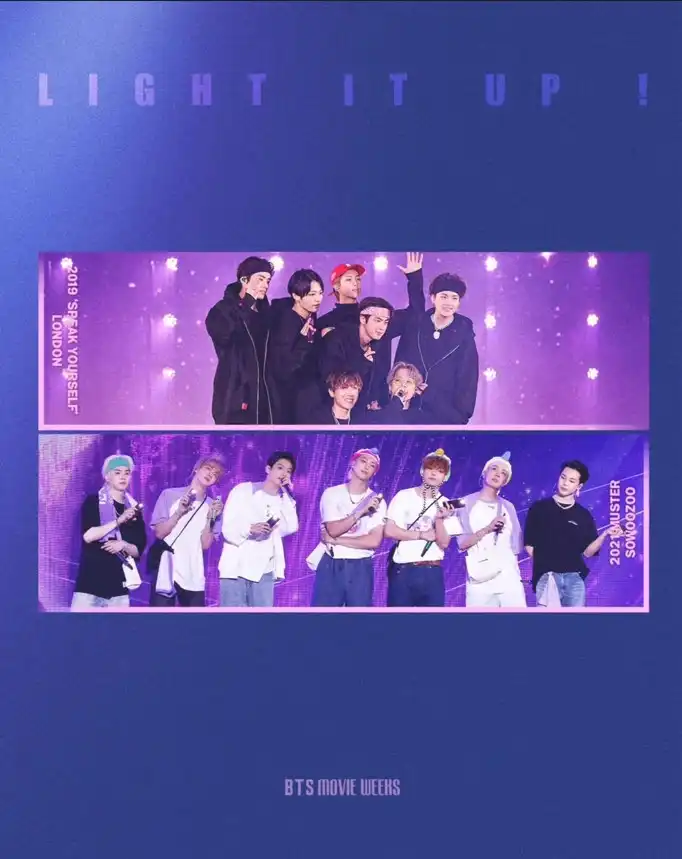

BTS Shines Again: Reunion, Return, and Recent Activities

6 months ago

Game On, Love Story: How Travis Kelce and Taylor Swift Rewrote the Playbook for Sports and Entertainment

6 months ago

Taylor Swift and Travis Kelce Engaged: A Love Story in the Spotlight

6 months ago

Idol Star Athletics Championships (ISAC) 2025: Viral Moments, Controversy, and Excitement in the Idol Arena

6 months ago