France's Tax Talk: 13 Million Households on the Hook

Randhir Singh - Tuesday, 29 July 2025 | 04:00 PM (WIB)

Heads Up, France! Your 2023 Tax Bill Might Hold a Surprise (and an Automatic Debit!)

Alright, folks, gather ‘round, because we’ve got some news that might make a good chunk of France go, “Wait, what just happened?” If you’re one of the lucky—or perhaps, not-so-lucky—thirteen million French households, you’re about to have a little chat with the Public Treasury. And by “chat,” we mean they’re coming to collect for your 2023 income tax. Yes, you read that right, thirteen million households!It’s a bit like when you think you’ve paid for dinner, but then the waiter comes back with an extra charge for that second soda you totally forgot about. Except, in this case, the soda is your income, and the waiter is the French tax authority. The long and short of it is: the amount of tax that was neatly withheld from your paychecks throughout 2023 – that little chunk of change you barely noticed disappear – actually fell short of your final tax liability. So, what’s the difference? On average, we’re talking about an extra 840 euros per household. Ouch. That’s not exactly pocket change, is it? For many, that’s a significant chunk of a monthly budget, or maybe a nice weekend getaway that just got re-routed to the taxman.So, Why the Surprise? Understanding the Withholding System

Now, before you start tearing your hair out or blaming some obscure government conspiracy, let’s pump the brakes a bit. This annual adjustment, while perhaps unwelcome, isn’t some grand scheme to catch you unawares. It’s actually a perfectly normal, albeit sometimes surprising, part of the income tax system ever since France introduced the "prélèvement à la source" – or as we know it in the Anglosphere, Pay As You Earn (PAYE) – back in 2019.Think about it this way: when you’re paid, a portion of your income tax is automatically deducted. The amount deducted is based on an estimate. This estimate considers your declared income, family situation, and any deductions or credits you might be eligible for. But life, as we all know, rarely sticks to a perfectly predictable script, especially over an entire year! Maybe you got a raise mid-year, or you started a side gig that brought in more income than anticipated. Perhaps your marital status changed, or you had fewer deductions than initially declared. Any of these shifts can mean that the estimated tax withheld throughout the year just wasn't enough to cover your actual tax burden when all was said and done on December 31st.It’s like setting your cruise control on a gentle slope, only to find the road suddenly turning uphill. Your car needs more power to maintain speed, and in this metaphor, that extra power is the additional tax you owe. It’s a retroactive "topping up" to make sure everyone pays their fair share based on their actual earnings and circumstances.

Did Earth Just Jump from 3D to 5D? Let's Deconstruct the Hype

6 months ago

South Korea Says "No More Pixels, More Pencils!" in Classrooms

6 months ago

Japan Earthquake Rumors: Between Manga Prophecies, Tourist Fear, and Scientific Reality

6 months ago

Marina Bay Sands to Become a New Icon with US$8–9 Billion Development

6 months ago

Global Water Crisis 2025: A Threat That Cannot Be Ignored

6 months ago

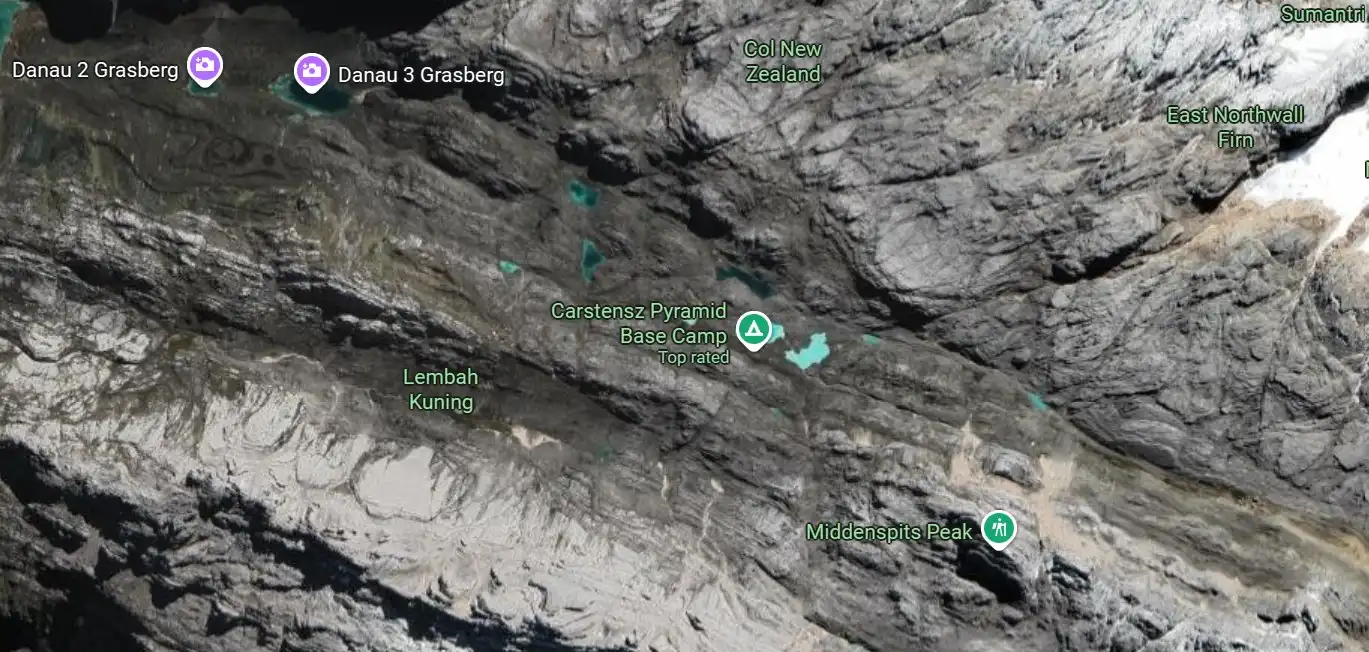

The Vanishing Crown: Global Warming's Grip on Carstensz Peak's Glaciers

6 months ago

The Pig Lungs That Could Change Everything: A New Dawn for Organ Transplants?

6 months ago

The Unseen Legacy: Chernobyl's Enduring Echoes on Life and Land

6 months ago

South Korea's Latest Crime-Fighting Gizmo: Say Hello to the Hologram Police!

6 months ago

The Cosmic Game of Hide-and-Seek: Beyond Planet X, Meet Planet Y?

6 months ago